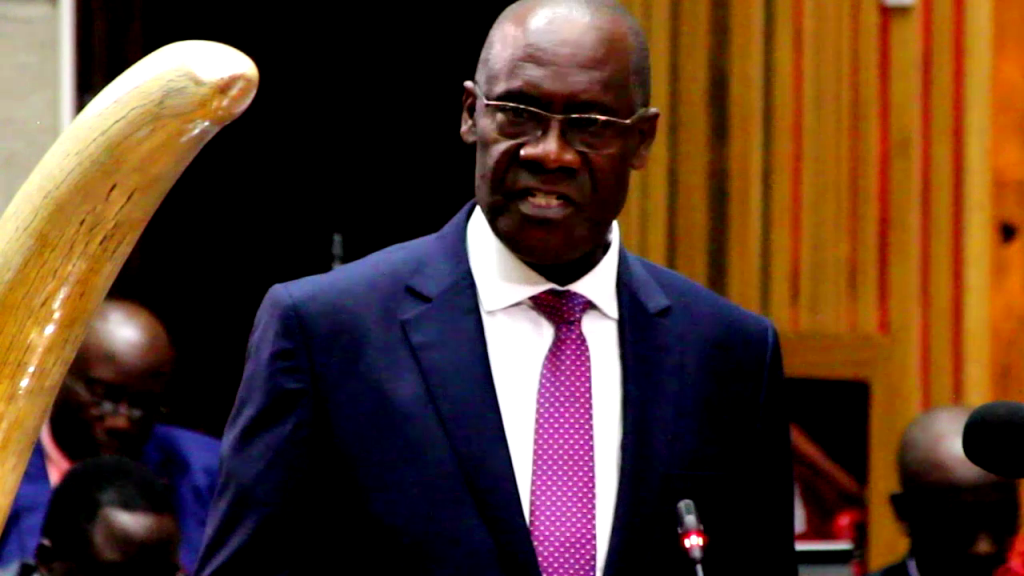

Finance Minister Bwalya Ng’andu has unveiled a K106 billion 2020 national budget, representing 32.4 percent of GDP.

And has government u-turned on the abolition of Value Added Tax (VAT) to replace it the controversial Sales Tax.

Presenting the budget in Parliament under the theme: “Focusing national priorities towards stimulating the domestic economy”, Dr Ng’andu says of the total K106 billion budget, K72 billion, representing 22.0 percent of GDP will come from domestic revenues, while the balance will be raised through domestic and external financing.

He says as a key strategy to stimulate economic activity, he has increased the allocation towards dismantling of arrears to K2.3 billion in 2020 from K437 million in 2019.

He says further, Government will reduce borrowing from the domestic market to 1.1 percent of GDP from 1.4 percent of GDP in 2019.

Dr Ng’andu states that the fiscal deficit is projected to reduce to 5.5 percent of GDP in 2020 from 6.5 percent in 2019.

He says this is a clear demonstration of Government’s resolve to restore fiscal health and stabilize the economy.

The Minister has also allocated K636 million towards redemption of the Eurobond.

Dr Ng’andu says in order to finance expenditure spelled out for the 2020 Budget, the Government expects to raise a total of K106.0 billion for the 2020 Budget of which K53.8 billion will be raised from taxes, K18.2 billion will come from non-tax revenues, and K3.1 billion will come as project support grants from Cooperating Partners.

He adds that domestic financing accounts for K3.5 billion while K27.5 billion will be sourced externally.

Dr Ng’andu states despite the tight fiscal position, Government has decided to maintain 20 direct tax rates to safeguard the disposable income of the people.

And the Minister says Government has decided to maintain the Value Added Tax, but address the compliance and administrative challenges.

He says in this regard, he will introduce administrative measures to strengthen enforcement and efficiency of VAT.

Meanwhile Dr Ng’andu has propose to suspend import duty, for three years, on the importation of machinery for processing of solid waste to generate electricity and produce organic fertilizers in order to encourage sustainable industrialisation while mitigating the effects of climate change,

Q FM Africa's Modern Radio

Q FM Africa's Modern Radio